Your friends in finance

Use our online application process Browse your options from over 50 leading banks

Choose your finance type

Home

By continuing you agree to our terms and conditions

Backed by our security promise

160+

Customers

50+

Lenders

$230m+

Loans Settled

How we can help Lendforce

Home Loan

There’s no place like home.

Refinancing

Revaluate your options.

Investment Loans

Build your portfolio.

Commercial Lending

Take your business to the next level.

Asset Lending

Leverage your assets.

SMSF Lending

Take control of your super.

50+ partners in lending

What We Do

We make finance easy. Simple. Straightforward. Streamlined.

Whether you’re growing your business or investment portfolio, buying your dream home, or capitalising on your superannuation, we’ll source suitable options for your circumstances, guide you with tailored support and pave the way for your success.

Compare faster

Powerful systems to compile and compare your options in no time at all.

What Australians are saying about Lendforce

4.9

From reviews

“The Lendforce team is exceptional. They really made sure that all my concerns were dealt with and the loan application was effortless from my end. Truly professional and understanding of making sure I was comfortable across every step of the process. They secured the lender, loan, amazing rate, and handled all the dealing required for the purchase of the property.”

Nathan | Sydney, March 2022

“When it came time for Studio Messa to acquire its first office premises, Lendforce was there to ensure the loan application was smooth and efficient. Their customer service is second to none. They secured an amazing rate for the loan and ensured the lender did everything we needed to settle by the settlement date. I cannot recommend Lendforce enough.”

Peter | Sydney, December 2021

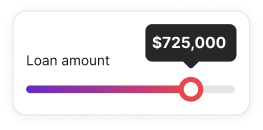

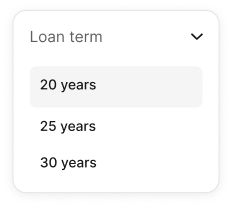

Plan and prepare with our range of handy calculators

Let's crunch the numbers

Get one step closer to your goals with Lendforce.

-

Easily calculate your loan

-

Compare loan deals across the board

-

Get the best rate with your credit score

Lendforce Learning Hub

Blog

5 Golden Tips for Successful Property Investing

Property investing can provide a means to achieve your long-term financial goals - but investing involves more than just acquiring an asset and expecting returns to follow. Not every investment will be successful but following these tips can help you make informed decisions with the potential for great returns.

Blog

How is Stamp Duty Calculated in NSW?

If you’ve purchased a property in NSW, you’ll have to pay stamp duty. Working out how much you will owe can be simply calculated using this tool. Below are some additional guidelines to help make the whole process simpler.

Blog

Things to Know Before Choosing a Finance Broker

Paying a mortgage can take many years, so choosing the right one is an important decision to make. There are a number of factors to consider before signing a contract, as outlined below, to help you find one best suited to your circumstances.

Simply lending.

Let’s work together.

Easy finance options from wherever you are in Australia. We’re committed to helping you reach your goals - big or small.

Footer

Stay in the loop

Insights and updates at your fingertips.

Suite 901, Level 9, 50 Clarence St, Sydney, NSW 2000

Lendforce Pty Ltd is a Credit Representative (ACR: 526857) of Vow Financial Pty Ltd (ACL:390261)

© 2026 Lendforce. All rights reserved.